The Digital Currency Revolution: Navigating the Future of Money

In the ever-evolving landscape of the global economy, digital currencies stand at the forefront of a financial revolution, challenging traditional banking systems and reshaping our understanding of money. This seismic shift towards digitalization promises to enhance the efficiency, accessibility, and security of financial transactions worldwide. This article delves into the origins of digital currencies, their impact on the global financial system, the challenges they face, and the potential they hold for a more inclusive and efficient future.

The Rise of Digital Currencies

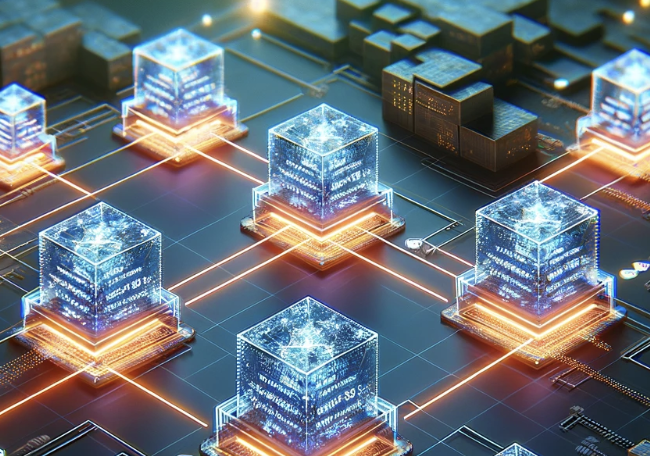

The journey of digital currencies began with the advent of Bitcoin in 2009, introduced as a peer-to-peer electronic cash system by an anonymous entity known as Satoshi Nakamoto. It marked the birth of cryptocurrencies - digital or virtual currencies secured by cryptography, operating independently of a central authority. The underlying technology, blockchain, ensures the integrity of transaction data, fostering trust in a system without intermediaries.

Impact on the Financial System

Impact on the Financial System

Digital currencies offer a radical departure from conventional financial mechanisms, presenting a host of advantages:

- Decentralization: By eliminating central intermediaries, digital currencies reduce transaction costs and times, offering a more efficient means of exchange.

- Financial Inclusion: They provide access to financial services for unbanked populations worldwide, contributing to economic empowerment.

- Security and Transparency: Blockchain technology ensures secure, transparent transactions, reducing fraud and corruption.

Challenges and Considerations

Despite their potential, digital currencies face significant hurdles:

- Volatility: The value of cryptocurrencies can be highly volatile, posing risks for investors and users.

- Regulatory Uncertainty: The lack of standardized global regulation complicates the integration of digital currencies into existing financial systems.

Technological Barriers: The widespread adoption of digital currencies requires robust technological infrastructure and digital literacy.

The Future of Money

The future of digital currencies lies in their potential to transform the financial landscape. Central bank digital currencies (CBDCs) are emerging as a promising development, with nations experimenting with blockchain technology to issue digital versions of their fiat currencies. This could harmonize the benefits of digital currencies with the stability and regulation of traditional money.

Moreover, advancements in blockchain technology continue to expand the possibilities for secure, efficient transactions, paving the way for innovative financial products and services. As digital currencies gain acceptance, they could offer a more inclusive, transparent financial system.

Conclusion

The digital currency revolution is redefining the essence of money and financial transactions in the 21st century. While challenges remain, the opportunities for efficiency, inclusion, and innovation are unprecedented. Navigating this transition requires careful consideration of the complexities involved, but the potential benefits for global financial systems and economies are immense. As we move forward, embracing the digital currency revolution could herald a new era of financial freedom and opportunity.

This exploration of the digital currency revolution highlights a pivotal moment in financial history, underscoring the transformative power of technology in shaping the future of money.

(Writer:Frid)